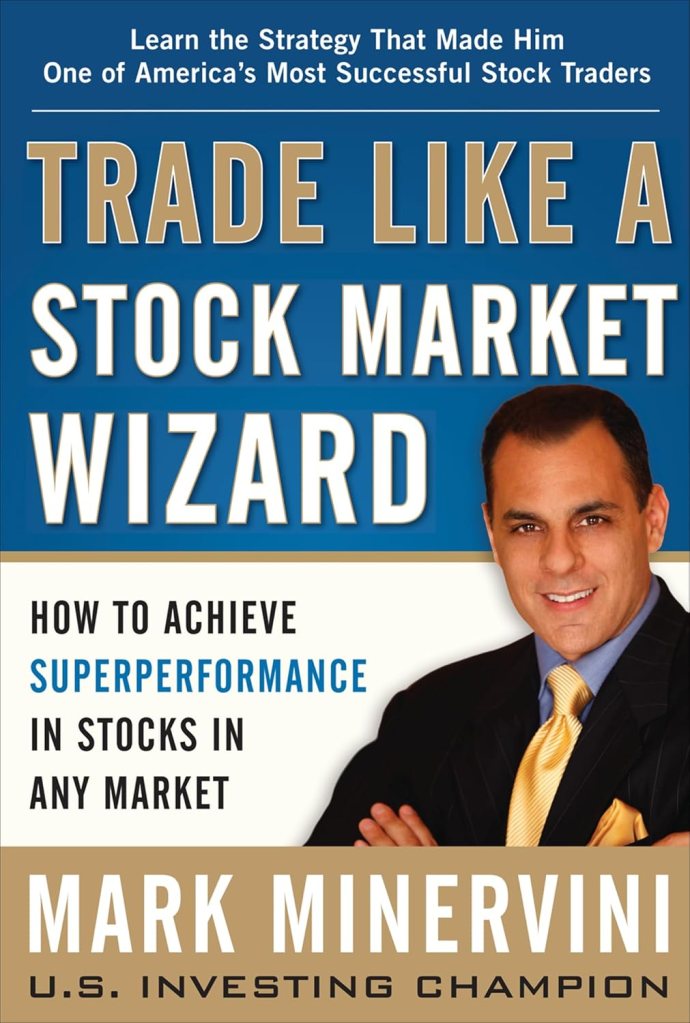

Unlock Superperformance: Trading Like a Stock Market Wizard with Mark Minervini

Many aspire to achieve great success in the stock market, but few truly do, often settling for mediocre or inconsistent results. This is because most investors operate on faulty assumptions rather than unbiased facts and often fail to develop the emotional discipline needed to execute a winning plan. What if there was a proven methodology to achieve “superperformance” in stocks, averaging returns far beyond what most imagine? Mark Minervini, a 1997 U.S. Investing Champion, offers just that in his book, “Trade Like a Stock Market Wizard: How to Achieve Superperformance in Stocks in Any Market”.

Minervini’s journey to stock market success began with humble beginnings, leaving school at age 15 and being almost entirely self-educated. He started with only a few thousand dollars but eventually built a fortune, averaging a staggering 220 percent per year from 1994 to 2000, resulting in a 33,500 percent compounded total return. He even managed to cash out ahead of eight bear markets, including two of the worst in U.S. stock market history. His success, he insists, is not a function of luck or circumstance, nor is it gambling, but rather achieved through knowledge, persistence, skill, and above all, discipline.

Challenging Conventional Wisdom: Why “Buy Low, Sell High” is Misunderstood

One of the most profound insights from Minervini’s approach challenges the widely accepted notion of “buy low and sell high”. In the stock market, what appears cheap can actually be expensive, and what looks expensive may turn out to be the next superperformance stock.

- The P/E Ratio: Overused and Misunderstood

- Minervini states that historical analyses of superperformance stocks suggest that P/E ratios, by themselves, are among the most useless statistics on Wall Street. The standard P/E ratio reflects historical results and does not account for future earnings or their revisions.

- Many of the biggest winning stocks in history traded at high P/E ratios (e.g., 30 or 40 times earnings, or even hundreds of times earnings like Yahoo! at 938x earnings) before their largest advances. Avoiding these stocks simply because their P/E or share price seems “too high” will cause investors to miss out on many of the biggest market movers.

- Conversely, buying a stock solely because it’s “cheap” or has a low P/E can be a “trap hand in poker”. If it falls further, it just becomes “even cheaper,” making it harder to sell and leading to big trouble for investors who look for bargains instead of leaders.

- “Value doesn’t move stock prices; people do by placing buy orders.” It’s the perception of value that influences people, not merely a valuation metric.

- The “Broken Leader Syndrome”

- This common affliction affects investors who refused to buy a dynamic new leader when it was emerging and then become interested only after the stock has topped and broken down in price (usually during a Stage 4 decline).

- They rationalize buying a stock that’s “down 70 percent” by thinking “How low can it go?”. Minervini warns: “How low can it go? To zero!”

- When a leader tops, it’s often discounting a future slowdown in growth, making it “no bargain at all”.

The SEPA® Strategy: Surgical Precision in Trading

Minervini’s core methodology is called Specific Entry Point Analysis® (SEPA®). It combines corporate fundamentals with the technical behavior of a stock to pinpoint the precise spot to enter a high-probability trade in terms of risk versus reward.

The Five Key Elements of SEPA®:

- Trend: Superperformance phases almost always occur when the stock price is in a definite uptrend.

- Catalyst: There’s usually an event that attracts attention and drives institutional interest, whether it’s new products, services, or industry developments.

- Entry Points: Superperformance stocks offer opportunities to catch a meteoric rise at a low-risk entry point. Timing is critical; incorrect timing can lead to being stopped out or big losses.

- Exit Points: Not all trades work out. Establishing stop-loss points is crucial to force out of losing positions and protect the account. Conversely, knowing when to sell to realize profits is equally important to “keep what you’ve made”.

- Leadership Profile®: This is Minervini’s blueprint of characteristics shared by superperformance stocks, identifying qualities of successful past stocks to determine future outperformers.

The SEPA® ranking process involves multiple filters:

- Stocks must first meet the Trend Template (discussed below).

- Qualifying stocks are then screened based on earnings, sales, margin growth, relative strength, and price volatility, with about 95% failing this screen.

- The remaining stocks are scrutinized for similarities to the Leadership Profile®, focusing on fundamental and technical factors of historical superperformers.

- The final stage is a manual review and “relative prioritizing” ranking process considering reported earnings/sales, earnings/sales surprise history, EPS/revenue growth and acceleration, company guidance, analyst estimate revisions, profit margins, industry/market position, potential catalysts, performance comparison within sector, price and trading volume analysis, and liquidity risk.

The ultimate goal of SEPA is “probability convergence”—identifying the point where fundamental, technical, and market factors align for the lowest risk and highest potential reward.

Understanding Stock Cycles: The Four Stages

Minervini’s method places great importance on understanding the four stages stocks go through in their life cycle:

- Stage 1 – Neglect Phase: Consolidation

- The stock moves sideways, often with lackluster fundamentals and light volume.

- “You should avoid buying during stage 1 no matter how tempting it may be; even if the company’s fundamentals look appealing, wait and buy only in stage 2.”

- Attempting to “bottom fish” in Stage 1 or 4 means sitting with “dead money” for months or years.

- Stage 2 – Advancing Phase: Accumulation

- This is the ideal stage for buying. The stock price escalates due to surging demand from big institutional buyers, fueled by earnings momentum or expectations.

- Characteristics: Price above 150-day and 200-day moving averages, 150-day above 200-day, 200-day trending up, higher highs and higher lows, and surging volume on rallies with light volume on pullbacks.

- Minervini’s Trend Template is used to pinpoint Stage 2: 8 criteria, including the current price being above 150-day and 200-day MAs, 200-day MA trending up for at least 1-4 months, 50-day MA above both 150-day and 200-day MAs, current price above 50-day MA, at least 30% above 52-week low (often 100-300% or more), within 25% of 52-week high, and relative strength ranking of at least 70 (preferably 80s or 90s). “A stock must meet all eight of the Trend Template criteria to be considered in a confirmed stage 2 uptrend.”

- Stage 3 – Topping Phase: Distribution

- Momentum slows, volatility increases with wider swings, and there’s often a major price break on increased volume.

- The 200-day moving average flattens and then rolls over. This is when smart money is getting out.

- Stage 4 – Declining Phase: Capitulation

- Earnings momentum is lost, negative surprises occur, and the stock is in a full-blown downtrend.

- Price action is mostly below the 200-day moving average, which is in a definite downtrend, and the stock hits new 52-week lows. “You should definitely avoid buying while a stock is in stage 4.”

The Power of Price and Volume: “A Picture Is Worth a Million Dollars”

Charts are an “invaluable tool” for discerning opportunities by depicting the battle between supply and demand. Minervini’s personal trading “relies on charting to the extent that I would never bet on my fundamental ideas alone without confirmation from the actual price action of the underlying stock”.

- Volatility Contraction Pattern (VCP)

- This is Minervini’s “Holy Grail” for identifying precise entry points. It signifies a contraction of volatility from left to right within a price base, accompanied by significantly contracting volume.

- The Contraction Count (or “Ts”) refers to the successive reductions in price volatility (e.g., 25% pullback, then 15%, then 8%).

- “When sellers become scarcer, the price correction will not be as dramatic, and volatility will decrease.” This indicates that “supply has stopped coming to market”.

- Shakeouts

- These are price movements designed to “weed out the weak holders”. A common tactic is for the stock to drop just below an obvious support level, triggering stops, before rallying higher.

- “You want the other weak holders to exit the stock before you buy.” Shakeouts within the base can strengthen the setup.

- The Pivot Point

- This represents the completion of a stock’s consolidation and the cusp of its next advance. It’s the “call to action” price level where a trade is triggered as the stock moves above this point on expanding volume.

- “Every correct pivot point will develop with a contraction in volume, often to a level well below average”. This signifies that “stock has stopped coming to market” and even a small amount of buying can move the price rapidly.

- “Tennis Ball Action”

- After a successful breakout from a VCP, if the stock is healthy and under accumulation, pullbacks will be brief and quickly met with support, pushing the stock to new highs, “bouncing back like a tennis ball”. This is how you know a stock is worth holding.

Fundamentals to Focus On: Beyond the Basics

While technical analysis dictates when to buy, Minervini emphasizes that superperformance stocks are driven by “real growth—in earnings and sales”.

- Earnings Surprises and Revisions

- “Most of the big institutional investors utilize valuation models that are based on earnings estimates to determine a stock’s current worth or value.”

- When a company reports quarterly results “meaningfully better than expected,” analysts revise estimates upward, increasing attention and buying interest. Studies show that upward revisions of 5% or more lead to better-than-average performance.

- Minervini looks for “strong earnings growth backed by brisk sales,” emphasizing companies with accelerating earnings (e.g., 30-40% or more, or even triple-digit rates during their best growth period).

- Code 33

- This is Minervini’s term for the “potent recipe” where a company shows three quarters of acceleration in earnings, sales, and profit margins simultaneously. This powerful combination dramatically boosts the bottom line and fuels explosive stock price appreciation.

- Earnings Quality and Red Flags

- Minervini warns against “massaged numbers,” “one-time charges,” and “revenue shifting” that can deceptively inflate earnings.

- “Sustainable earnings growth requires revenue growth.” Be cautious if profitability is primarily from cost-cutting, as these measures have limited lifespan.

- Monitor inventories and accounts receivables relative to sales; if they grow much faster than sales without explanation, it’s a red flag.

Risk Management: The Unavoidable Cost of Success

Minervini considers risk management the “most important building block for achieving consistent success”. He asserts that “the first and best investment you can make is an investment in yourself, a commitment to do what it takes and to persist.”

- Cut Your Losses Short

- “The single most important factor for winning big as a speculator” is avoiding large losses.

- Losses work geometrically against you: a 50% decline requires a 100% gain to break even. A 10% loss requires only an 11% gain to break even.

- Minervini’s Loss Adjustment Exercise demonstrated that if all his past losses were capped at 10%, his negative compounded return would have transformed into a +79.89% gain.

- “Set an absolute maximum line in the sand of no more than 10 percent on the downside.” Your average loss should be much less, perhaps 6% or 7%.

- “Involuntary Investor”

- A critical mistake is becoming an “involuntary investor”—a trader who holds onto losing positions for the “long term” because they hate to admit mistakes. “Being wrong is unavoidable, but staying wrong is a choice.”

- Position Sizing and Scaling In

- Minervini recommends “pilot buys” (initiating smaller positions) when coming out of a cash position, and only increasing exposure incrementally as trades prove profitable.

- “By pyramiding up when you’re trading well and tapering off when you’re trading poorly, you trade your largest when trading your best and trade your smallest when trading your worst.”

- “Never trust the first price unless the position shows you a profit.”

- Discipline Over Emotion

- “Good trading is boring; bad trading is exciting and makes the hair on the back of your neck stand up.”

- Contingency planning is essential: “Have things thought out in advance” so you can take “swift, decisive action” without emotional debate.

- “Honor Thy Stop”: Once your predetermined stop-loss point is hit, “sell it immediately without exception or hesitation”.

Conclusion

Mark Minervini’s “Trade Like a Stock Market Wizard” offers a comprehensive, disciplined approach to stock trading. It’s about moving beyond conventional wisdom, mastering specific entry and exit points, understanding market cycles and the dynamics of supply and demand through charts, and rigorously managing risk. It demands persistence, dedication, and a commitment to continuous learning. As Minervini states, “Believe you can do it. That’s the first thing you need to know.”