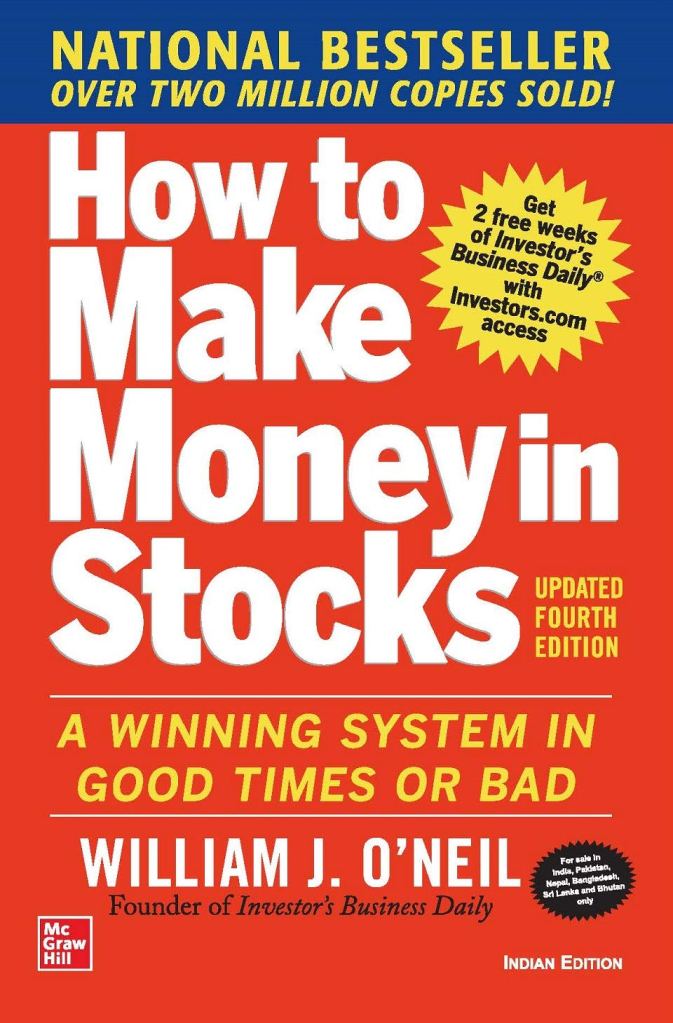

Mastering the Market: William J. O’Neil’s Path to Investment Success

The world of stock market investing can seem daunting, especially after periods of significant volatility like the market debacles of 2000 and 2008. Many investors feel lost, unsure who to trust or what strategies to adopt to achieve superior performance. William J. O’Neil, author of “How to Make Money in Stocks,” offers a clear, historically proven system designed to navigate both good times and bad. This isn’t about relying on gurus or fleeting fads; it’s about understanding the market’s underlying mechanics and acting intelligently based on factual data.

O’Neil emphasizes that successful investing isn’t about being right all the time, but rather about learning from experience and developing sound principles. He learned from his own mistakes, identifying counter-intuitive truths about the market. For instance, you should buy stocks when they’re rising in price and nearer their annual highs, not when they seem “cheap” because they’ve fallen. Furthermore, relying on fundamental metrics like book value, dividends, or P/E ratios has had little predictive value for spotting America’s most successful companies over the last century. Instead, focus on profit growth, price and volume action, and whether a company is a leader in its field with a superior product.

The core of O’Neil’s strategy is encapsulated in his CAN SLIM system, a simple, easy-to-remember formula derived from an intensive study of over 1,000 of the biggest winning companies in market history, dating back to the 1880s. Each letter represents a crucial characteristic common to these super-performing stocks just before their explosive price advances.

The CAN SLIM Winning System

Here’s a breakdown of the CAN SLIM methodology:

- C = Current Big or Accelerating Quarterly Earnings and Sales Per Share This is considered the single most important element in stock selection. Winning stocks typically show a major percentage increase in current quarterly earnings per share (EPS) compared to the same quarter a year earlier. O’Neil’s research found that three out of four top-performing stocks from 1952 to 2001 showed earnings increases averaging over 70% in the latest reported quarter before their major advances. From 1910 to 1950, top performers saw 40% to 400% earnings gains. It’s not just about the size of the increase, but also earnings acceleration. If a company’s earnings have been growing at 15% and suddenly jump to 40-50% or more, that’s a strong signal. This growth should also be supported by sales growth of at least 25% for the latest quarter, or an acceleration in the sales percentage improvement over the last three quarters. Beware of companies inflating earnings by cutting costs without corresponding sales growth, as seen with Waste Management. Profit margins should also be at or near a new high and among the best in the industry. Always compare current quarterly EPS to the same quarter a year earlier to avoid seasonal distortions. Be wary of misleading earnings reports that focus on total net income or one-time extraordinary gains rather than EPS. Insist on a minimum of 18-20% EPS growth, but preferably 40-500% or more in bull markets.

- A = Annual Earnings Increases Beyond strong current quarterly earnings, a high-quality company must demonstrate a record of solid annual earnings growth. Look for annual EPS that have increased in each of the last three years, ideally at a rate of 25%, 50%, or even 100% or more. The median annual growth rate for outstanding stocks in O’Neil’s study between 1980 and 2000 was 36%. Additionally, Return on Equity (ROE) is a crucial measure of efficiency. Nearly all great growth stocks of the past 50 years had ROEs of at least 17%, with superior situations showing 25% to 50% ROEs. Consistency and stability in annual earnings growth over the past three years are also important, often indicated by a low “stability figure” (below 20-25). This ensures you’re investing in proven growth rather than erratic or cyclical recoveries.

- N = Newer Companies, New Products, New Management, New Highs Significant price moves in stocks are driven by something new – a revolutionary product or service, new management invigorating a company, or major shifts in industry conditions. Over 95% of successful stocks with stunning growth in American history fit into at least one of these categories. Examples include the transcontinental railroad, the automobile, radio, TV, computers, and the internet. Crucially, O’Neil introduces the “Great Paradox”: What seems too high in price and risky to the majority usually goes higher, and what seems low and cheap usually goes lower. This means you should buy stocks as they emerge from sound, properly formed chart bases and begin to make new highs in price on increased volume. This “new high” is not a sign of being overvalued but often the beginning of a significant price advance. The perfect time to buy is in a bull market as a stock breaks out of its price base.

- S = Supply and Demand The basic principle of supply and demand dictates stock prices. It’s harder to move the price of a stock with billions of shares outstanding (large supply) than one with fewer shares (smaller supply). While smaller-cap stocks can be more volatile, they offer greater opportunity. Look for companies where top management owns a significant percentage of stock, aligning their interests with shareholders. The best way to measure supply and demand is by watching daily trading volume. When a stock pulls back, volume should dry up, indicating selling pressure has exhausted. When it rallies, volume should rise, signifying institutional buying. During breakouts from price consolidation areas, trading volume should be at least 40-50% above normal, often increasing 100% or more, signaling strong buying interest and potential for further price increases.

- L = Leader or Laggard Always buy market leaders and avoid laggards. A leader is not necessarily the largest company but the one with the best quarterly and annual earnings growth, highest return on equity, widest profit margins, strongest sales growth, and most dynamic stock-price action. It will also have a unique and superior product or service and be gaining market share. Avoid “sympathy plays” – stocks in the same industry that are cheaper but lack the real leader’s fundamental strength. The Relative Price Strength (RS) Rating is a proprietary measure from Investor’s Business Daily (IBD) that compares a stock’s price performance against all other stocks over the past 52 weeks, rated from 1 to 99 (99 being best). The average RS Rating for the best-performing stocks before their major run-ups was 87. O’Neil recommends restricting purchases to stocks with RS Ratings of 80 or higher, with the really big moneymakers typically having RS Ratings of 90 or higher just before breaking out.

- I = Institutional Sponsorship Institutional investors (mutual funds, pension funds, etc.) are the largest source of demand for stocks, accounting for the lion’s share of market activity. A winning stock doesn’t need a huge number of institutional owners but should have several at a minimum, ideally increasing in number in recent quarters. Look for quality sponsorship – stocks held by at least one or two savvy portfolio managers with the best performance records (e.g., A+ or B+ rated mutual funds). Significant new positions taken by institutions are particularly relevant. However, beware of “overowned” stocks, where institutional ownership becomes excessive, creating large potential selling pressure if conditions turn negative.

- M = Market Direction This is paramount: you can be right about every other CAN SLIM factor, but if you’re wrong about the general market direction, you will lose money. O’Neil asserts that timing the market is possible and essential, contrary to popular myth. The best way to determine market direction is by observing and interpreting the daily charts of major general market averages like the S&P 500 and Nasdaq Composite. A critical signal for market tops is a “distribution day”: when a major index closes lower on higher volume, or shows stalling action (small price increase) on heavy volume. Four or five such days over a four-to-five-week period usually signal an impending market downturn. For market bottoms, look for a “follow-through day” on the fourth to seventh day of an attempted rally, characterized by a booming gain on heavier volume than the previous day. No new bull market has ever started without a strong price and volume follow-through confirmation. O’Neil advises individual investors to raise cash and get off margin in the early stages of a bear market, preserving capital for future opportunities.

Critical Risk Management: The Art of Selling

Many investors focus intensely on buying but neglect the equally, if not more, important aspect of selling. O’Neil contends that a strong defense is key to winning big in investing.

- Cut Every Loss Short: The 7% or 8% Rule Always limit your loss on initial capital in each stock to an absolute maximum of 7% or 8%. This rule has no exceptions, regardless of company news or perceived value. If a stock drops by this amount from your purchase price, it indicates you’ve either made a mistake in selection or the general market is turning. This is like an insurance policy; you’re limiting your risk to a comfortable level. While a stock you sell might turn around, adhering to this rule prevents catastrophic losses. A 33% loss requires a 50% gain just to break even; a 50% loss requires a 100% gain. You simply cannot afford to sit with a stock where the loss keeps getting worse. The “Turkey Story” illustrates the common investor mistake of hoping a losing stock will recover rather than cutting losses. Investors often suffer from a “price-paid bias,” holding onto losers while selling winners simply because they’re up. Instead, evaluate your portfolio based on current relative price performance, selling the weakest and adding to the strongest.

- Avoid Averaging Down Averaging down, or buying more shares of a stock that is already showing a loss, is a common and dangerous mistake. The market does not care about your hopes; it only obeys supply and demand.

- Be a Speculator, Not an Investor (by O’Neil’s definition) Drawing on Bernard Baruch and Jesse Livermore, O’Neil defines a “speculator” as someone who observes and acts before the future occurs, constantly watching the market and individual stocks to determine current action and then acting decisively. An “investor” by Livermore’s definition, who makes a bet and stays with it even if it goes wrong, risks losing everything. There is no such thing as a “long-term investment” once a stock drops into the loss column.

Final Thoughts on Education and Egos

O’Neil stresses that success in the market has little to do with education, IQ, or external advice. In fact, intelligence and ego can be detrimental, leading people to believe they know better than the market itself. The market is almost always right; fighting it is an expensive mistake.

The CAN SLIM system is not “momentum investing” in the superficial sense of just buying stocks that have gone up the most. Instead, it’s about identifying companies with strong fundamentals (sales and earnings growth from new products) and buying them at precise times as they emerge from proper price consolidation periods, before dramatic run-ups. It also heavily emphasizes knowing when to sell to protect gains during bear markets.

Ultimately, O’Neil empowers individual investors to take control of their financial future. By diligently studying market facts, learning to read charts, and strictly applying proven buy and sell rules, anyone can learn to invest wisely and capitalize on the relentless growth opportunities America offers. It requires effort, discipline, and humility, but the rewards are substantial.